Below is the well respected Haver Analytics take on the numbers:

"· On the surface, the 431,000 gain in May payrolls after an unrevised 290,000 April rise looks strong but, in fact, it was not. First, the increase was raised by the one-time hiring of 411,000 Census workers. Second, the gain actually fell short of Consensus expectations for a 508,000 rise in the total. Lastly, the 41,000 gain in private sector payrolls was the weakest since January.

· The shortfall in private sector was broad-based. Construction sector hiring fell 35,000 and reversed the increases in the prior two months. Private services-sector hiring rose just 37,000 following firmer gains during five of the prior six months. The weakness reflected a 6,000 decline (-0.8% y/y) in retail sector hiring, a 12,000 decline (-2.2% y/y) in financial sector employment and a soft 2,000 increase (-0.3% y/y) in leisure & hospitality jobs.

· Countering some sense of labor-market softness was a decline in the civilian unemployment rate to 9.7%, although that just reversed the April increase. Moreover, the decline was all due to a 322,000 shrinkage (-0.4% y/y) in the labor force, the first drop since December. Household sector employment, in fact, also declined 35,000 (-0.7% y/y) which was the first drop this year."

Housing

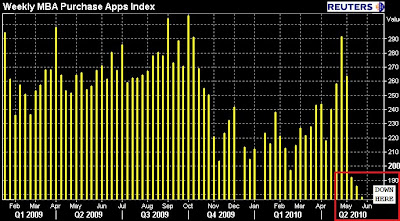

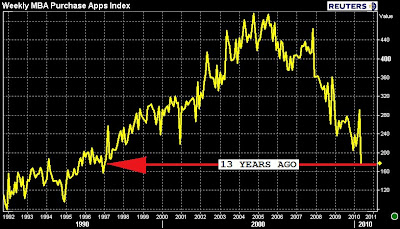

As you can see below, housing is unwinding faster than I could have ever imagined. Mortgage applications have essentially fallen off a cliff since the tax credit ended based on yesterday's data from the MBA.

Some blurbs from the report:

"With another week of historically low mortgage rates, the trend from the prior three weeks continued, as refinance applications increased while purchase applications dropped. Purchase applications are now almost 40 percent below their level four weeks ago, while the refinance share, at 74 percent, is at its highest level since December," said Michael Fratantoni, MBA's Vice President of Research and Economics. "In addition, the ARM share dropped last week to its lowest level since March of this year, as borrowers took the opportunity to lock in at historically low fixed mortgage rates."

My Take:

Folks, both sets of data above are absolutely horrifying. Housing applications are falling at rates never seen before. At the same time, the number of potential home buyers continues to shrink due to rising unemployment.

This is a recipe for disater for the housing market and the banks that hold these bloated assets.

The jobs report looks even worse when you throw the bogus birth death rate model out of these numbers. We are essentially seeing negative job growth in the private sector.

Imagine what the jobs report is going to look like when the part time census gig dries up!

The Bottom Line

I didn't even have the chance to get into the bad news flowing out of Europe this morning. The Euro is once again hitting yearly lows against the dollar.

There are rumors floating around that banking giant Soc Gen is in trouble due to their derivatives exposure. We also learned today that the IMF is running out of money after bailing out Greece.

All in all it appears things are going to hell in a hand basket at a pretty rapid pace. Treasuries soared today as a result of the continuing fear of collapse in Europe. Lets not forget we need to peddle another $124 billion of these notes next week. Treasuries should be really interesting to watch next week.

All I can say is hold on tight folks. Things are getting seriously bad out there, and the bailout funds this go around are simply not there to create a second government based recovery.

The next time we roll over we have two choices:

1. Cut off the money spigot and sink into a deflationary depression.

or

2. Print our way out of this mess which will create severe inflation and the strong possibility of hyperinflation.

It's up to the Fed as to which path we take. Lets hope Ben takes door #1. Hyperinflation or even severe inflation will almost assuredly result in severe social unrest and the potential collapsing of the US government because people will not be able to afford to live.

Please take whatever measures you can to prepare yourself for whats coming. This situation is deteriorating rapidly and you are in for a rude awakening if you are not prepared:

Raise as much cash as you can, payoff debt, reduce expenses, buy some inflation protected assets like gold.

The situation is dire out there and I haven't been this concerned since late 2008.