I had a rather disturbing conversation with a real estate agent who works primarily with Fannie Mae in my area. The "cash for keys" program has been around in real estate for a long time but I didn't know a lot about it until last night.

We began talking about housing slowdown she started compaining about the rampant abuse of Fannie Mae's "cash for keys" program. Needless to say I was totally shocked(and sickened) at what I heard.

Before I continue, keep in mind that I have no hard details about the abuses of this program, and this may not be completely accurate because I only have the one source above. I saw no documentation to confirm what I heard.

So let's continue. So I started to ask lots of questions about the details of the program. The Realtor got angry as she started giving me the details because she feels the taxpayer is being completely raped by the process.

Using this program during normal times when the foreclosure rate is 1% on prime loans is one thing. It's a whole different story today as our deficit deepens and foreclosure rates soar.

So here's how it works. Deadbeat homeowners who aren't paying their mortgage are basically being bribed with hard cash from Fannie Mae to leave their house.

The money is for "moving expenses" and the number of dollars various depending on what the deadbeat says it will cost them to move. She has seen the numbers range from $1000 up to $3700(which is the highest she saw).

The incentive for Fannie of course is once the deadbeat leaves they can then get the foreclosure process started so they can recoup what they can on the house, take the hit, and then move on.

At this point I wanted a little more detail. So I asked: "What about the banks that have done Fannie loans? Are they being forced to take the loss via foreclosure?" The Realtor explained that the bank has the right to turn down "cash for keys" program.

However, if they accept it, a price is set at a much lower value(based on what they believe it will list for as a foreclosure) and Fannie then buys the loan from the bank for the price they determined. This is all done before the "cash for keys" is offered since Fannie is the one making the deal.

What angered her(and me) was how easy these deals are being approved at our expense(since we the taxpaers backstop Fannie). She explained then explained how the "cash for keys" is executed.

The Realtor approaches the deadbeat buyer and asks them what it will cost them to "walk away" and move from the house(she added that many of these borrowers have not made a mortgage payment in 2 years). The deadbeat then throws out a number like $3000. The agency then goes to Fannie and gives them the number.

Without hesitation Fannie accepts the offer and the check is cut. This Realtor told me she has NEVER seen ONE instance where Fannie has not accepted the offer from the deadbeat. There is a limit to what can be offerd for moving expenses but whe couldn't recall it because she has never seen an offer turned down.

This whole thing made me SICK of course once I learned how the who thing works. Why is the government cutting checks to people who have been living in a house for free for a year or two? How do they have the right to throw around our taxpayer dollars like this?

What's even more disgusting about this program is once word gets out among the neiborhoods that Fannie is cutting $3000 checks to get you to leave the home, half of the neighborhood follows(especially in the lower income areas according to this agent) as their homes fall further and further underwater.

She is now starting to worry that many homeowners in certain areas are going to just take the check and walk away.

Folks, we have to start asking ourselves if this program should be continued at a time when borrowers are already tempted to say "screw it" and bail on their loans.

I asked her if all the banks are involved with this. She said that they deal mainly with JP Morgan and Bank of America. However, she did emphasized that this is a Fannie Mae program and the only way the bank participates is by dumping the loan to Fannie who then offers the "cash for keys" program.

The Bottom Line

So I guess we now have a "stealth" bailout for deadbeat homeowners. The Realtor above told me that the industry calls this "Fannie's dirty little secret".

I'll tell ya, I get more and more disgusted the more I learn about the housing fraud. The whole damn thing stinks to high heaven.

BTW

This Realtor also added that the foreclosure moratorium has brought housing to a standstill in the area.

Today's newspaper headline confirmed her thoughts:

"Sales of existing homes in the Rochester region tumbled during the third quarter after the expiration of federal tax credits that drew thousands of buyers into the market.

"Data released Friday by the Greater Rochester Association of Realtors showed that resales in the 11-county region served by the organization fell 27 percent from July through September compared with the same period of 2009.

"Right now, what Rochester real estate is experiencing is post-tax credit shock," said Armand D'Alfonso, president and CEO of Nothnagle Realtors, the region's largest realty firm.

Data released Friday by the Greater Rochester Association of Realtors showed that resales in the 11-county region served by the organization fell 27 percent from July through September compared with the same period of 2009.

There were 2,664 closings during the third quarter, 964 fewer than a year earlier. Despite the slack demand, selling prices edged up by 1

"Right now, what Rochester real estate is experiencing is post-tax credit shock," said Armand D'Alfonso, president and CEO of Nothnagle Realtors, the region's largest realty firm.

"The phone totally stopped ringing after April 30," said Nunzio Salafia, an agent and co-owner of ReMax Plus in Brighton. "A lot of people did not buy because they were clinging to the hope that the government would do something," such as extend the credits, as happened once before."

Stay tuned. The housing crash gets uglier by the second and prices are headed in only one direction:

Saturday, October 23, 2010

Friday, October 22, 2010

"The Sellout of America"

That's what trends guru Gerald Celente calls it. He also puts a lot of the blame on the media for letting the elites get away with this disgusting fraud.

I couldn't agree more.

There is no accountability anywhere at this point. The press have become nothing but a platform for whatever message Washington or Wall St wants to send to the serfs on Main St.

The Wall St bonus pool for 2010 is absoutely obnoxious.

As you are asking yourself "How in the heck did things get so tough this year?" as you pull coins out of your couch in order to pay for Christmas, you need to look no farther than Wall St.

Thanks to you and your taxpayer dollars, the pigmen will have an enjoyable holiday season as they binge on the $140 billion in bonus payouts that they successfully stole from your pockets in 2010.

Let's hope Gerald is right and people start to wake the heck up.

On a Lighter Note:

Take a look at this hilarious Wanda Sykes segment from Jay Leno. I would have loved to embedded this but NBC copyrighted it.

An absolute classic isn't it?

Here is another funny one from Weird Al Yankovic on the economy. I didn't even know this guy was still making music. Funny stuff Al!

Enjoy.

I couldn't agree more.

There is no accountability anywhere at this point. The press have become nothing but a platform for whatever message Washington or Wall St wants to send to the serfs on Main St.

The Wall St bonus pool for 2010 is absoutely obnoxious.

As you are asking yourself "How in the heck did things get so tough this year?" as you pull coins out of your couch in order to pay for Christmas, you need to look no farther than Wall St.

Thanks to you and your taxpayer dollars, the pigmen will have an enjoyable holiday season as they binge on the $140 billion in bonus payouts that they successfully stole from your pockets in 2010.

Let's hope Gerald is right and people start to wake the heck up.

On a Lighter Note:

Take a look at this hilarious Wanda Sykes segment from Jay Leno. I would have loved to embedded this but NBC copyrighted it.

An absolute classic isn't it?

Here is another funny one from Weird Al Yankovic on the economy. I didn't even know this guy was still making music. Funny stuff Al!

Enjoy.

POMO Disappointment

The POMO front running traders were disappointed this morning as the Fed only bought 10% of what was offered from the primary dealers versus the average 20-30% we have seen in recent POMO's:

"Operation Date: 10/22/2010

Operation Type: Outright Coupon Purchase

Release Time: 10:15 AM

Close Time: 11:00 AM

Settlement Date: 10/25/2010

Maturity/Call Date Range: 04/15/2013 - 09/30/2014

Total Par Amt Accepted (mlns) : $2,490

Total Par Amt Submitted (mlns) : $24,808"

My Take:

As a result, the banks only got $2.49 billion in gambling money from the Fed. Without the NY Fed's "juice" there are few bids for stocks or anything else.

It's a sad day in this country when our government decides what direction all asset classes trade instead of the free markets.

I don't see why anyone would want to be involved in such a cesspool.

Expect a giant nothing burger today, and I expect that we close flat to lower by the end of the session barring any news.

After a wild week I think you would have more fun doing this today:

"Operation Date: 10/22/2010

Operation Type: Outright Coupon Purchase

Release Time: 10:15 AM

Close Time: 11:00 AM

Settlement Date: 10/25/2010

Maturity/Call Date Range: 04/15/2013 - 09/30/2014

Total Par Amt Accepted (mlns) : $2,490

Total Par Amt Submitted (mlns) : $24,808"

My Take:

As a result, the banks only got $2.49 billion in gambling money from the Fed. Without the NY Fed's "juice" there are few bids for stocks or anything else.

It's a sad day in this country when our government decides what direction all asset classes trade instead of the free markets.

I don't see why anyone would want to be involved in such a cesspool.

Expect a giant nothing burger today, and I expect that we close flat to lower by the end of the session barring any news.

After a wild week I think you would have more fun doing this today:

Thursday, October 21, 2010

It's Still All About Housing

This is the reality folks. It's impossible to turn around this economy without the housing market.

The reason I say this is because housing touches almost everything. Without a robust housing market the banks are toast and it doesn't stop there. There is a rippling effect then filters down throughout many industries.

Think about the different parties that are involved:

You have builders, Realtors, and finance that are directly effected.

Then you have the indirects who also suffer when housing sputters like every industry that fill our homes with luxuries whether it be furniture or technology.

When you really drill it down, almost everything in our economy has some link back to housing.

This is the reason why the Fed has taken such unprecedented steps in supporting this area of the economy. They have basically put themselves "all in" on turning iaround housing.

They really had no choice when you think about it. Without housing the financial system is esentially toast. The size of the mortgage market is around $10 trillion according to the last figures I saw which is close to 100% of our annual GDP.

The steps they have taken to prop up housing are startling when you think about it. They have gotten mortgage rates under 4%, backstopped Fannie and Freddie, and backstopped or bailed out half of Wall St.

So how is their bet working out? It's failed miserably when you look at the numbers:

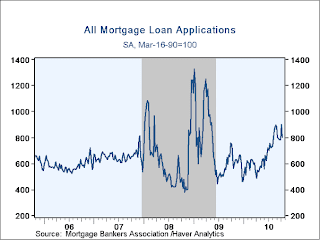

The headlines of course will tell you a different story. They will say mortgage applications continue to rise and at first sight they are right:

However, when you dig into the numbers, they aren't pretty because the majority of these applications are refi's:

Applications for purchase(which is the only number that matters) continues to plummet:

My Take:

Since the housing tax credit evaporated the housing market has basically collapsed. That bottom chart tells you all you need to know. As you can see we are far below the levels of activity that were seen during the depths of the worst recession since the 1930's.

We are seeing this free fall despite the fact that interest rates are at ALL TIME LOWS.

What's scary here is I expect this number to get markedly worse moving forward because the foreclosure market has been shut down by the banks.

Can you imagine how fugly those numbers are going to look as the foreclosure moratorium gets more baked into the cake? These were the only houses that were really selling before the moratorium.

The Bottom Line

The numbers never lie. Housing was a bubble and it's popping like all bubbles do: Violently!

The Fed and the other retards can scream recovery all they want. The harsh reality is it's not happening folks despite what the stock market is telling you. This is not a new secular bull market that we have seen since since March of 2009.There will be no sustained tally in the market without the financials.

The Fed can spend trillions and goose the DOW up to 12,000 if it wants but I can tell you right now: It's not gonna hold. Not as long as housing looks like it does above.

The sad truth is without housing the banks collapse and without the banks we have no financial system.

The Fed knows this and it's the reason why they are using every trick they have in their book to reflate the housing bubble. Ben is on his hands and knees right now praying to god that you buy a house.

Despite all of their efforts it "ain't happening". Housing prices are down 30-70% from the highs(depending on the market), interest rates are at all time lows, and Americans have reacted by doing absolutely NOTHING.

As long as they continue to sit on their hands this economy is going to go nowhere.

The Fed can keep rates at zero, throw the currency in the toilet, and QE all they want...It's not gonna matter.

Until Fed realizes this was the wrong path to take there will be no recovery. Housing must be left alone and prices must correct down to levels where there is demand.

Spending our grandchildren's money trying to stop this inevitable correction is simply just plain silly and it puts our whole way of life at risk.

It's time to walk away Mr. Bernanke and let the market forces do their job.

The reason I say this is because housing touches almost everything. Without a robust housing market the banks are toast and it doesn't stop there. There is a rippling effect then filters down throughout many industries.

Think about the different parties that are involved:

You have builders, Realtors, and finance that are directly effected.

Then you have the indirects who also suffer when housing sputters like every industry that fill our homes with luxuries whether it be furniture or technology.

When you really drill it down, almost everything in our economy has some link back to housing.

This is the reason why the Fed has taken such unprecedented steps in supporting this area of the economy. They have basically put themselves "all in" on turning iaround housing.

They really had no choice when you think about it. Without housing the financial system is esentially toast. The size of the mortgage market is around $10 trillion according to the last figures I saw which is close to 100% of our annual GDP.

The steps they have taken to prop up housing are startling when you think about it. They have gotten mortgage rates under 4%, backstopped Fannie and Freddie, and backstopped or bailed out half of Wall St.

So how is their bet working out? It's failed miserably when you look at the numbers:

The headlines of course will tell you a different story. They will say mortgage applications continue to rise and at first sight they are right:

However, when you dig into the numbers, they aren't pretty because the majority of these applications are refi's:

Since the housing tax credit evaporated the housing market has basically collapsed. That bottom chart tells you all you need to know. As you can see we are far below the levels of activity that were seen during the depths of the worst recession since the 1930's.

We are seeing this free fall despite the fact that interest rates are at ALL TIME LOWS.

What's scary here is I expect this number to get markedly worse moving forward because the foreclosure market has been shut down by the banks.

Can you imagine how fugly those numbers are going to look as the foreclosure moratorium gets more baked into the cake? These were the only houses that were really selling before the moratorium.

The Bottom Line

The numbers never lie. Housing was a bubble and it's popping like all bubbles do: Violently!

The Fed and the other retards can scream recovery all they want. The harsh reality is it's not happening folks despite what the stock market is telling you. This is not a new secular bull market that we have seen since since March of 2009.There will be no sustained tally in the market without the financials.

The Fed can spend trillions and goose the DOW up to 12,000 if it wants but I can tell you right now: It's not gonna hold. Not as long as housing looks like it does above.

The sad truth is without housing the banks collapse and without the banks we have no financial system.

The Fed knows this and it's the reason why they are using every trick they have in their book to reflate the housing bubble. Ben is on his hands and knees right now praying to god that you buy a house.

Despite all of their efforts it "ain't happening". Housing prices are down 30-70% from the highs(depending on the market), interest rates are at all time lows, and Americans have reacted by doing absolutely NOTHING.

As long as they continue to sit on their hands this economy is going to go nowhere.

The Fed can keep rates at zero, throw the currency in the toilet, and QE all they want...It's not gonna matter.

Until Fed realizes this was the wrong path to take there will be no recovery. Housing must be left alone and prices must correct down to levels where there is demand.

Spending our grandchildren's money trying to stop this inevitable correction is simply just plain silly and it puts our whole way of life at risk.

It's time to walk away Mr. Bernanke and let the market forces do their job.

10 Year Bond Action

I will be back later but thought I would throw the 10 year bond up:

This is very strange price action.

Why is the 10 year selling off as the market reverses downward?

We should be seeing the exact opposite. This isn't a huge move but it's disturbing to say the least. Treasuries are supposed to be the safest of all safe havens. You would expect them to rise after seeing a nasty triple digit reversal like we did today.

I guess when the government that backs them is bankrupt they all of the sudden don't look so safe anymore.

This is very strange price action.

Why is the 10 year selling off as the market reverses downward?

We should be seeing the exact opposite. This isn't a huge move but it's disturbing to say the least. Treasuries are supposed to be the safest of all safe havens. You would expect them to rise after seeing a nasty triple digit reversal like we did today.

I guess when the government that backs them is bankrupt they all of the sudden don't look so safe anymore.

Wednesday, October 20, 2010

Jim Rogers Hammers CNBC

I think I will start with asking a question in Canadian: What a wacky couple days in the market eh?

Whoa! Volatility is back!

None of this helps from a confidence standpoint of course. The dollar trade the past few days was absolutely ridiculous:

Crazy isn't it?

Folks, moves like this on the dollar just are not supposed to happen. Stocks and other commodities caught fire once the dollar started collapsing this morning.

We sold off later in the day to close up around 1%.

What was interesting today was watching the bond market. Take a look at the t10 year:

As you can see, bonds actually moved higher despite the sharp rally in stocks. We should have seen bonds move int he other diection as the market soared higher.

This pretty much tells you that there wasn't much conviction behind the rally. Most investors remain scared and prefer to sit in bonds.

The move higher was all about the falling dollar today.

Why this is a good thing for stocks is beyond me. I also think that all of the money the Fed is creating one of the reasons why we are seeing both stocks and bonds rising at the same time.

We had another POMO from the Fed today like we saw on Monday so today's move makes a little more sense from a "funny money" standpoint.

Fundamentally of course none of this makes any sense, but we all know those have gone out the window for the time being.

Just keep one thing in the back of your mind: The fundamentals always matter. Just ask anyone that leveraged themselves into the tech bubble.

Let me finish up with a great video from Jim Rogers that was done on CNBC Asia last night.

Jim hits the cover off the ball as he slams CNBC, and rips into the artificial book values of the banks that the analysts feed the bulltards on Bubblevision.

Enjoy!

Whoa! Volatility is back!

None of this helps from a confidence standpoint of course. The dollar trade the past few days was absolutely ridiculous:

Crazy isn't it?

Folks, moves like this on the dollar just are not supposed to happen. Stocks and other commodities caught fire once the dollar started collapsing this morning.

We sold off later in the day to close up around 1%.

What was interesting today was watching the bond market. Take a look at the t10 year:

As you can see, bonds actually moved higher despite the sharp rally in stocks. We should have seen bonds move int he other diection as the market soared higher.

This pretty much tells you that there wasn't much conviction behind the rally. Most investors remain scared and prefer to sit in bonds.

The move higher was all about the falling dollar today.

Why this is a good thing for stocks is beyond me. I also think that all of the money the Fed is creating one of the reasons why we are seeing both stocks and bonds rising at the same time.

We had another POMO from the Fed today like we saw on Monday so today's move makes a little more sense from a "funny money" standpoint.

Fundamentally of course none of this makes any sense, but we all know those have gone out the window for the time being.

Just keep one thing in the back of your mind: The fundamentals always matter. Just ask anyone that leveraged themselves into the tech bubble.

Let me finish up with a great video from Jim Rogers that was done on CNBC Asia last night.

Jim hits the cover off the ball as he slams CNBC, and rips into the artificial book values of the banks that the analysts feed the bulltards on Bubblevision.

Enjoy!

Dollar Down/Stocks Up.. Conversation with "The Credit Trader"

Stocks are higher as Wall St digests yesterdays wild day. The one thing that caught my eye this morning was the dollar has given back a lot of it's gains from yesterday:

My Take:

Was that Chinese induced dolar rally a one day wonder? Wouldn't surprise me if it was. There is really no real fundamental reason why this country should have a strong currency given our massive debts.

This has definitely been a nice tailwind for stocks today as the lower dollar/long stock robotraders get a chance to come out and play.

"You Don't Wanna Go There"

I often speak about my friend "the credit trader" on this blog, and I had a chance to speak with him yesterday after the market close.

Needless to say it was a very depressing conversation. I spoke to him about some of the things I wrote about yesterday. We discussed exposing the losses from the banks and foreclosuregate.

When it came to exposing the losses he repeatedly told me: "Jeff, you don't wanna go there". I pushed on pleading that we need to get to the bottom of this and expose the fraud!

He was silent for a bit and said it again: "Jeff, I'm tellin ya, you don't wanna go there".

When I ask why he basically argues that the losses are too big for the government to handle and the system would fold like a cheap tent.

I responded by offering up the Band Aid Theory where I argued: "Isn't it better to rip it off and move on now versus sitting here and slowly have it pulled off as the system unravels?"

He replied: " Jeff, there's no way out of it so why open that can of worms?".

He basically thinks that our quality of life is going to dramatically drop when this all comes to fruition so why rush it?

"The credit trader" believes that we should enjoy whats left of the system we have enjoyed for 30 years because when it finally rolls over it's going to be ugly for years if not a decade.

He also doesn't believe that things will get worse if we hold off because the system is screwed:

His explanation is simple: Our total obligations when you include Social Security and Medicare are about $181 trillion according to his calculations. There is no way that these obligations can be met when you look at our GDP.

Essentially, his argument is zero will still be zero later so what's the rush to expose it? It can't be fixed in either scenario.

I have to admit that it makes me pause when I think about it. I guess we all need to ask ourselves: Do we REALLY want to know what lies behind the curtains?

Will our bank accounts immediately be vaporized if the fraud is exposed? I actually asked him that BTW and he replied that it's a very possible outcome. He also added that seeing people stuffing money under their mattress after the fraud was exposed wouldn't surprise him either.

At the same time, he is also humble enough to admit that he doesn't have any answers to the problem. He also doesn't believe anyone knows how this exactly will play out. He hates the fraud as much as all of us do but he just doesn't see any fiscal solution.

I also asked him about foreclosuregate. He laughed and said that Band of America is only "the tip of the iceberg" when it comes to the lawsuits. He also added that the mortgage insurance dilemma is the biggest nightmare moving forward. As he explained "Who on earth would offer mortgage insurance for any foreclosure right now, and without it, what bank would ever touch the loan?"

We kinda wrapped it up there. He doesn't like to talk about this stuff for too long, and I have to admit it was so gloomy that I was ready to shut it down as well.

You know it's interesting. I get opportunities to sit and hang out with him and his Wall St buddies every once in awhile. Some of them are way way way up the food chain.

I will ask them about the market and what I find is none of them really want to talk about it. They are all as bearish as he is. Their attitude is basically "We're screwed so why waste the time trying to fix it?".

I guess I can't blame them .

Most of these guys made millions by being eternal optimists. This attitude worked for 30 years as the DOW rose from 1-2k in the early 1980's all the way up to 14k in 2006.

As a result, coming to terms with the reality that their craft has been destroyed is obviously very difficult for them to accept so they don't like to discuss it.

Perhaps taking their attitudes and sitting back and enjoying what's left of our lives is the best way to cope with this tragedy. After all life is short.

Until later.

My Take:

Was that Chinese induced dolar rally a one day wonder? Wouldn't surprise me if it was. There is really no real fundamental reason why this country should have a strong currency given our massive debts.

This has definitely been a nice tailwind for stocks today as the lower dollar/long stock robotraders get a chance to come out and play.

"You Don't Wanna Go There"

I often speak about my friend "the credit trader" on this blog, and I had a chance to speak with him yesterday after the market close.

Needless to say it was a very depressing conversation. I spoke to him about some of the things I wrote about yesterday. We discussed exposing the losses from the banks and foreclosuregate.

When it came to exposing the losses he repeatedly told me: "Jeff, you don't wanna go there". I pushed on pleading that we need to get to the bottom of this and expose the fraud!

He was silent for a bit and said it again: "Jeff, I'm tellin ya, you don't wanna go there".

When I ask why he basically argues that the losses are too big for the government to handle and the system would fold like a cheap tent.

I responded by offering up the Band Aid Theory where I argued: "Isn't it better to rip it off and move on now versus sitting here and slowly have it pulled off as the system unravels?"

He replied: " Jeff, there's no way out of it so why open that can of worms?".

He basically thinks that our quality of life is going to dramatically drop when this all comes to fruition so why rush it?

"The credit trader" believes that we should enjoy whats left of the system we have enjoyed for 30 years because when it finally rolls over it's going to be ugly for years if not a decade.

He also doesn't believe that things will get worse if we hold off because the system is screwed:

His explanation is simple: Our total obligations when you include Social Security and Medicare are about $181 trillion according to his calculations. There is no way that these obligations can be met when you look at our GDP.

Essentially, his argument is zero will still be zero later so what's the rush to expose it? It can't be fixed in either scenario.

I have to admit that it makes me pause when I think about it. I guess we all need to ask ourselves: Do we REALLY want to know what lies behind the curtains?

Will our bank accounts immediately be vaporized if the fraud is exposed? I actually asked him that BTW and he replied that it's a very possible outcome. He also added that seeing people stuffing money under their mattress after the fraud was exposed wouldn't surprise him either.

At the same time, he is also humble enough to admit that he doesn't have any answers to the problem. He also doesn't believe anyone knows how this exactly will play out. He hates the fraud as much as all of us do but he just doesn't see any fiscal solution.

I also asked him about foreclosuregate. He laughed and said that Band of America is only "the tip of the iceberg" when it comes to the lawsuits. He also added that the mortgage insurance dilemma is the biggest nightmare moving forward. As he explained "Who on earth would offer mortgage insurance for any foreclosure right now, and without it, what bank would ever touch the loan?"

We kinda wrapped it up there. He doesn't like to talk about this stuff for too long, and I have to admit it was so gloomy that I was ready to shut it down as well.

You know it's interesting. I get opportunities to sit and hang out with him and his Wall St buddies every once in awhile. Some of them are way way way up the food chain.

I will ask them about the market and what I find is none of them really want to talk about it. They are all as bearish as he is. Their attitude is basically "We're screwed so why waste the time trying to fix it?".

I guess I can't blame them .

Most of these guys made millions by being eternal optimists. This attitude worked for 30 years as the DOW rose from 1-2k in the early 1980's all the way up to 14k in 2006.

As a result, coming to terms with the reality that their craft has been destroyed is obviously very difficult for them to accept so they don't like to discuss it.

Perhaps taking their attitudes and sitting back and enjoying what's left of our lives is the best way to cope with this tragedy. After all life is short.

Until later.

Tuesday, October 19, 2010

It's Time For The Banks To Come Clean

Before I start, let me apologize for blogging the last few days like a bipolar person that hasn't taken their mood stabilizer in a few months:)

The reason I have been so vocal recently is because I am becoming terrified by what I see when I watch what's happening in the markets.

I see the foreclosuregate freight train heading right for us. It's gaining steam by the minute, and if it isn't stopped soon it will be too late.

The way I see it, there is only one answer. It's time for the truth. Take a listen to Congressman Elijah Cummings comments about how this crisis is effecting American families and I will continue below:

My Take:

This video did a great job vocalizing how I think most Americans(including myself) feel.

No one knows how bad this foreclosure mess is, and the only way to find out is by opening up the banks balance sheets and seeing what the losses are. Only then can we deal with this situation appropriately.

There was a report out today that there are $650 billion worth of mortgages that are now underwater. God only knows what this number would look like if housing prices drop another 20-30% or more as a result of this foreclosure fiasco.

We are talking trillions of dollars here folks.

Look...Everyone knows the numbers of bad...In fact they are probably way worse then any of us can imagine.

The banks actions over the past few weeks are an easy "tell" that the situation is dire.

As Elijah says above: There is NO WAY the banks would ever stop the foreclosure process via a moratorium unless there were major issues with the foreclosure process and/or the means in which their MBS securitizations were packaged.

Think about it, a moratorium is the worst case scenario for the banks. They have to sit there and pay property taxes while they eat a loan that has no income coming in.

On top of that, without anyone in the house, it's not being maintained and it becomes vulnerable to squatters, crackheads, and vandals.

In other words it's the worst case scenario for a bank. For awhile, the banks seemed hesitant to foreclose because they didn't want to take the loss. They also didn't want to foreclose because they were worried about flooding the market with too much inventory which would further depress home prices.

Now, all of the sudden out of the blue, they can't get the homeowners out fast enough! What I'd like to know is why the sudden change in heart?

Take a look at the newest game the large banks have created in order to speed up the foreclosure process and make a few extra bucks on the side as they toss desperate Americans out of their homes who have run out of options:

Folks, these criminals must be stopped!

So let's ask the obvious question: Why are the banks all of the sudden doing a full court press when it comes to speeding up the foreclosure process?

Could it be that they want to sweep this foreclosure nightmare underneath the rug as fast as they can in order to avoid the consequences of creating the largest fraud in the history?

Guess what guys, it's too late. You have been BUSTED.

The Bottom Line

The only way out of this mess is to expose the fraud and see what the damages are no matter how ugly they are.

The economy is going to continue to unravel if we keep the status quo because there is no confidence.

The congressman explained it perfectly above: Americans have lost trust in the financial markets and the enforcement of the rule of law.

They don't trust stocks, they don't trust the banks, and they don't trust the housing market. Heck, at this point they aren't even sure they know if they own their own house.

We need to get to the bottom of this before all confidence is destroyed.

The fraud must be cleansed from our banking system. Who knows? Maybe it's not even as bad as we think. Perhaps by some small miracle the banks have found a way to earn their way out of a lot of this.

History has continually shown us that markets are destroyed when there is no confidence in the system. Our situation is no different.

We are very very close to hitting Less than Zero. Let's hope we stop before it's too late:

The reason I have been so vocal recently is because I am becoming terrified by what I see when I watch what's happening in the markets.

I see the foreclosuregate freight train heading right for us. It's gaining steam by the minute, and if it isn't stopped soon it will be too late.

The way I see it, there is only one answer. It's time for the truth. Take a listen to Congressman Elijah Cummings comments about how this crisis is effecting American families and I will continue below:

My Take:

This video did a great job vocalizing how I think most Americans(including myself) feel.

No one knows how bad this foreclosure mess is, and the only way to find out is by opening up the banks balance sheets and seeing what the losses are. Only then can we deal with this situation appropriately.

There was a report out today that there are $650 billion worth of mortgages that are now underwater. God only knows what this number would look like if housing prices drop another 20-30% or more as a result of this foreclosure fiasco.

We are talking trillions of dollars here folks.

Look...Everyone knows the numbers of bad...In fact they are probably way worse then any of us can imagine.

The banks actions over the past few weeks are an easy "tell" that the situation is dire.

As Elijah says above: There is NO WAY the banks would ever stop the foreclosure process via a moratorium unless there were major issues with the foreclosure process and/or the means in which their MBS securitizations were packaged.

Think about it, a moratorium is the worst case scenario for the banks. They have to sit there and pay property taxes while they eat a loan that has no income coming in.

On top of that, without anyone in the house, it's not being maintained and it becomes vulnerable to squatters, crackheads, and vandals.

In other words it's the worst case scenario for a bank. For awhile, the banks seemed hesitant to foreclose because they didn't want to take the loss. They also didn't want to foreclose because they were worried about flooding the market with too much inventory which would further depress home prices.

Now, all of the sudden out of the blue, they can't get the homeowners out fast enough! What I'd like to know is why the sudden change in heart?

Take a look at the newest game the large banks have created in order to speed up the foreclosure process and make a few extra bucks on the side as they toss desperate Americans out of their homes who have run out of options:

Folks, these criminals must be stopped!

So let's ask the obvious question: Why are the banks all of the sudden doing a full court press when it comes to speeding up the foreclosure process?

Could it be that they want to sweep this foreclosure nightmare underneath the rug as fast as they can in order to avoid the consequences of creating the largest fraud in the history?

Guess what guys, it's too late. You have been BUSTED.

The Bottom Line

The only way out of this mess is to expose the fraud and see what the damages are no matter how ugly they are.

The economy is going to continue to unravel if we keep the status quo because there is no confidence.

The congressman explained it perfectly above: Americans have lost trust in the financial markets and the enforcement of the rule of law.

They don't trust stocks, they don't trust the banks, and they don't trust the housing market. Heck, at this point they aren't even sure they know if they own their own house.

We need to get to the bottom of this before all confidence is destroyed.

The fraud must be cleansed from our banking system. Who knows? Maybe it's not even as bad as we think. Perhaps by some small miracle the banks have found a way to earn their way out of a lot of this.

History has continually shown us that markets are destroyed when there is no confidence in the system. Our situation is no different.

We are very very close to hitting Less than Zero. Let's hope we stop before it's too late:

PIMCO, Blackrock, NY Fed Demand Bad Loan Repurchases from Bank of America

Well now we know what institutions are going after Bank of America(as reported here last night):

"Pacific Investment Management Co., BlackRock Inc. and the Federal Reserve Bank of New York are seeking to force Bank of America Corp. to repurchase soured mortgages packaged into $47 billion of bonds by its Countrywide Financial Corp. unit, people familiar with the matter said.

The bondholders wrote a letter to Bank of America and Bank of New York Mellon Corp., the debt’s trustee, citing alleged failures by Countrywide to service the loans properly, their lawyer said yesterday in a statement that didn’t name the firms. "

Quick Take:

The market tanked on the news as the foreclosure crisis continues to deteriorate and threaten the very existence of the TBTF banks.

Bank of America's stock sank below $12 on the news:

Stocks are now down 200 points on the session as Wall St tries to get it's arms around this shocking development.

The reality here folks is the pigmen are now starting to turn on each other as the fraud becomes exposed.

Any smart fellow knows that you want to be the first one off the boat when the ship starts sinking so I am not surprised that the best firms on Wall St(Blackrock, PIMCO) are the first ones that are looking to bail before this sucker takes on too much water.

The fireworks have just begun.

"Pacific Investment Management Co., BlackRock Inc. and the Federal Reserve Bank of New York are seeking to force Bank of America Corp. to repurchase soured mortgages packaged into $47 billion of bonds by its Countrywide Financial Corp. unit, people familiar with the matter said.

The bondholders wrote a letter to Bank of America and Bank of New York Mellon Corp., the debt’s trustee, citing alleged failures by Countrywide to service the loans properly, their lawyer said yesterday in a statement that didn’t name the firms. "

Quick Take:

The market tanked on the news as the foreclosure crisis continues to deteriorate and threaten the very existence of the TBTF banks.

Bank of America's stock sank below $12 on the news:

Stocks are now down 200 points on the session as Wall St tries to get it's arms around this shocking development.

The reality here folks is the pigmen are now starting to turn on each other as the fraud becomes exposed.

Any smart fellow knows that you want to be the first one off the boat when the ship starts sinking so I am not surprised that the best firms on Wall St(Blackrock, PIMCO) are the first ones that are looking to bail before this sucker takes on too much water.

The fireworks have just begun.

Chinese Rate Hike Shocker Slams Equities

Now this was an interesting surprise:

"BEIJING (MNI) - The People's Bank of China said Tuesday that benchmark deposit and lending rates will be increased, marking the first such adjustment since December 2007 and the global financial crisis.

The central bank said that the one-year deposit rate and one-year lending rate will each be increased by 25 basis points, effective October 20.

The one-year deposit rate will stand at 2.5% and the one-year lending rate at 5.56% following the adjustments.

No explanation for the move was provided in the short statement on the bank's website.

The National Bureau of Statistics is scheduled to release the latest inflation data on Thursday morning."

My Take:

This is what took the markets down this morning. The Yuan is pegged to the US dollar and visa versa so essentially, this was a stealth way for the US to raise rates without effecting it's banks or balance sheet.

This is all pretty frickin sneaky but I have to admit it's a brilliant move by the Fed. This was abviously a coordinated event between China and the US.

The US Dollar of course soared on the news:

Commodities like gold crashed on the news which should be expected after a rate hike:

What concerned me most about today's price action was the drop in longer dated treasuries. Take a look at the 30 year bond:

Quick Take:

The ten year was also down. One must ask themselves where in the heck is money going if it's flying out of stocks, bonds, and commodities?

The Bottom Line

The rate hike by the Chinese was definitely an olive branch extended to the US as the currency wars escalate.

The Fed certainly needed a break given the foreclosure mess. Adding to today's selling pressure is the reaction to the IBM and Apple earnings.

I had warned that these stocks were priced for perfection and this is being reflected in this morning's trading. The NASDAQ has been hardest hit of all the major indices today.

Until later!

"BEIJING (MNI) - The People's Bank of China said Tuesday that benchmark deposit and lending rates will be increased, marking the first such adjustment since December 2007 and the global financial crisis.

The central bank said that the one-year deposit rate and one-year lending rate will each be increased by 25 basis points, effective October 20.

The one-year deposit rate will stand at 2.5% and the one-year lending rate at 5.56% following the adjustments.

No explanation for the move was provided in the short statement on the bank's website.

The National Bureau of Statistics is scheduled to release the latest inflation data on Thursday morning."

My Take:

This is what took the markets down this morning. The Yuan is pegged to the US dollar and visa versa so essentially, this was a stealth way for the US to raise rates without effecting it's banks or balance sheet.

This is all pretty frickin sneaky but I have to admit it's a brilliant move by the Fed. This was abviously a coordinated event between China and the US.

The US Dollar of course soared on the news:

Commodities like gold crashed on the news which should be expected after a rate hike:

What concerned me most about today's price action was the drop in longer dated treasuries. Take a look at the 30 year bond:

Quick Take:

The ten year was also down. One must ask themselves where in the heck is money going if it's flying out of stocks, bonds, and commodities?

The Bottom Line

The rate hike by the Chinese was definitely an olive branch extended to the US as the currency wars escalate.

The Fed certainly needed a break given the foreclosure mess. Adding to today's selling pressure is the reaction to the IBM and Apple earnings.

I had warned that these stocks were priced for perfection and this is being reflected in this morning's trading. The NASDAQ has been hardest hit of all the major indices today.

Until later!

Monday, October 18, 2010

First Shots Fired in the Foreclosuregate War!

And we're off..............

"Institutional Holders of Countrywide-Issued RMBS Issue Notice of Non-Performance Identifying Alleged Failures by Master Servicer to Perform Covenants and Agreements in More Than $47 Billion of Countrywide-Issued RMBS

PR Newswire

8:05 PM Eastern Daylight Time Oct 18, 2010

HOUSTON, Oct. 18 /PRNewswire/ --Today, the holders of over 25% of the Voting Rights in more than $47 billion of Countrywide-issued RMBS sent a Notice of Non-Performance (Notice) to Countrywide Home Loan Servicing, as Master Servicer ("Countrywide Servicing"), and to Bank of New York, as Trustee, identifying specific covenants in 115 Pooling and Servicing Agreements (PSAs) that the Holders allege Countrywide Servicing has failed to perform.

The Holders' Notice alleges that each of these failures has materially affected the rights of the Certificateholders under the relevant PSAs. Under Section 7.01 of the PSAs, if any of the cited failures "continues unremedied for a period of 60 days after the date on which written notice of such failure has been given ... to the Master Servicer and the Trustee by the Holders of Certificates evidencing not less than 25% of the Voting Rights evidenced by the Certificates," that failure constitutes an Event of Default under the PSAs.

In a previous release, the Holders emphasized their intent to invoke all contractual remedies available to them to recover their losses and to protect their rights. Kathy Patrick of Gibbs & Bruns LLP, lead counsel for the Holders, emphasized that the Holders' notice does not seek to halt loan modifications for troubled borrowers. Instead, it urges the Trustee to enforce Countrywide Servicing's obligations to service loans prudently by maintaining accurate loan records, demanding the repurchase of loans that were originated in violation of underwriting guidelines, and compelling the sellers of ineligible or predatory mortgages to bear the costs of modifying them for homeowners or repurchasing them from the Trusts' collateral pools.

Patrick also noted that the group of Holders that tendered today's Notice of Non-Performance is larger, and encompasses more Countrywide-issued RMBS deals, than were included in the August 20 instruction letter. When asked why the group of holders was larger, Patrick replied, "Ours is a large, determined, and cohesive group of bondholders. We have a clearly defined strategy. We plan to vigorously pursue this initiative to enforce Holders' rights."

Quick Take:

Well that didn't take long. I thought the legal vultures would need a little more time.

Bend over Bank of America! I bet you now deeply regret the day you were forced to eat that Countrywide s**t sandwich.

This is going to get really interesting. The institutions involved in these suits have pockets just as deep as the banks, and it's become pretty clear as foreclosuregate gains traction that they were sold a pile of MBS dog doo that appears to be worthless.

As the muddied waters become more clear, the institutions realize that it's better to be first in line because there likely won't be any money left down the road as everyone lawyers up and begins demanding to be made whole.

Wait until the pensions get on board this train. This is a trillion dollar nightmare folks.

Banker versus Banker. What more could you ask for?

"Institutional Holders of Countrywide-Issued RMBS Issue Notice of Non-Performance Identifying Alleged Failures by Master Servicer to Perform Covenants and Agreements in More Than $47 Billion of Countrywide-Issued RMBS

PR Newswire

8:05 PM Eastern Daylight Time Oct 18, 2010

HOUSTON, Oct. 18 /PRNewswire/ --Today, the holders of over 25% of the Voting Rights in more than $47 billion of Countrywide-issued RMBS sent a Notice of Non-Performance (Notice) to Countrywide Home Loan Servicing, as Master Servicer ("Countrywide Servicing"), and to Bank of New York, as Trustee, identifying specific covenants in 115 Pooling and Servicing Agreements (PSAs) that the Holders allege Countrywide Servicing has failed to perform.

The Holders' Notice alleges that each of these failures has materially affected the rights of the Certificateholders under the relevant PSAs. Under Section 7.01 of the PSAs, if any of the cited failures "continues unremedied for a period of 60 days after the date on which written notice of such failure has been given ... to the Master Servicer and the Trustee by the Holders of Certificates evidencing not less than 25% of the Voting Rights evidenced by the Certificates," that failure constitutes an Event of Default under the PSAs.

In a previous release, the Holders emphasized their intent to invoke all contractual remedies available to them to recover their losses and to protect their rights. Kathy Patrick of Gibbs & Bruns LLP, lead counsel for the Holders, emphasized that the Holders' notice does not seek to halt loan modifications for troubled borrowers. Instead, it urges the Trustee to enforce Countrywide Servicing's obligations to service loans prudently by maintaining accurate loan records, demanding the repurchase of loans that were originated in violation of underwriting guidelines, and compelling the sellers of ineligible or predatory mortgages to bear the costs of modifying them for homeowners or repurchasing them from the Trusts' collateral pools.

Patrick also noted that the group of Holders that tendered today's Notice of Non-Performance is larger, and encompasses more Countrywide-issued RMBS deals, than were included in the August 20 instruction letter. When asked why the group of holders was larger, Patrick replied, "Ours is a large, determined, and cohesive group of bondholders. We have a clearly defined strategy. We plan to vigorously pursue this initiative to enforce Holders' rights."

Quick Take:

Well that didn't take long. I thought the legal vultures would need a little more time.

Bend over Bank of America! I bet you now deeply regret the day you were forced to eat that Countrywide s**t sandwich.

This is going to get really interesting. The institutions involved in these suits have pockets just as deep as the banks, and it's become pretty clear as foreclosuregate gains traction that they were sold a pile of MBS dog doo that appears to be worthless.

As the muddied waters become more clear, the institutions realize that it's better to be first in line because there likely won't be any money left down the road as everyone lawyers up and begins demanding to be made whole.

Wait until the pensions get on board this train. This is a trillion dollar nightmare folks.

Banker versus Banker. What more could you ask for?

Party On America!

I think I have figured out my sales pitch if I decide to become a stock broker. In fact, I have even role played it in my head. Feel free to tell me what you think:

Jeff(me)"Hello Mr. Smith."

Mr. Smith: "Hi Jeff. You have any investment ideas?"

Jeff: "Yes, I advise you to buy everything?"

Mr Smith: "Huh?"

Jeff: "Everything was up again today..... Stocks, bonds, gold, silver. I suggest you buy all of it."

Mr. Smith: "That is unusual isn't it?"

Jeff: "I know I know it's not supposed to happen but c'mon Mr. Smith. The dollars down! Every investment goes up now just like housing does...You just have to join the party."

Mr Smith: But what about the fundamentals?

Jeff: "Did you just ask me about the fundamentals? HAHAHA.. Don't be so silly Mr. Smith! Who cares about those? Trust me...NOW is the time to buy. You gotta be in it to win it!"

Let me pause here. I just thought of a great idea for my pitch:

I think I might crank a tune up in the middle of my sales pitch so he can get a feel for how fun it is when everything goes up.

Ah! here we go. This one would be PERFECT:

Back to my role play

Mr. Smith: "Jeff, I don't know, I am really concerned about the dollar. Oil was up $2.00 again today."

Jeff: "Oil schmoil. Apple just rocked up over $315!"

Mr. Smith: "Aren't you concerned about the currency wars? The Yen just broke to new highs again today against the dollar."

Jeff: "Mr. Smith. When was the last time you were over in Japan? Do you really think that bothers us over here?...Mr Smith, Trust me. It's time for you to GET IN THE GAME MY FRIEND! DON'T GET PRICED OUT!"

Sarcasm Off

Sadly, in the real world, Mr. Smith likely would have taken the bait and given me his lifetime savings to invest into this casino.

Folks don't kid yourselves: This is a casino. This betting parlor has been purposely created by The Fed with it's zero interest rate policy. I showed you the game that was being played today by the Fed in this morning's post.

Money is flying all over the place just like you would see at a craps table at 3AM in Las Vegas. Everyone is taking numbers and hoping the "stock gods" that are backed by the Fed somehow take us higher.

Unemployment, the economy, and investing are no longer important. Investors aren't invited to this party. In fact, there is a sign on the door of the market that says "speculators only".

Sadly, most of the clowns that are "all in" will stay at the party too long and will end up getting caught with their pants down. It's no different then the guy who walks into a casino for the first time and wins $5000 in the first hour only to find himself broke with a $1000 hooker on his lap by the end of the night.

Apple and IBM Earnings

Apple and IBM both beat solidly after hours. IBM sold off pretty hard on the news and Apple was halted last I checked. Looks like the market isn't happy with the numbers. Futures are down.

As I have said before, the market is priced for perfection. Beating isn't enough. You need to "Google" it and beat by 20+% in order to Ponzi your stock up to higher levels.

Forclosuregate Intensifies

This just keeps getting uglier by the second. Bank of America announced today that it plans on restarting the foreclosure "boiler room" in 23 states next week. The legal profession keeps telling them "not so fast my friend" and continues to take on foreclosure victims as clients.

Take some time and watch this video of 30 year real estate attorney April Charney who warned about this problem several years ago:

My Take:

The money quote from April is this: "The profit was separated from the risk". Essentially, the insinuation here is that the banks got their profits up front and didn't really care how clean the securitization was as long as Moody's rated it AAA.

I am sure BAC has met with their lawyers and have developed new paperwork in order to start foreclosing again. I am sure they have also put together a defense for the people who have already been thrown out of their houses.

I don't buy it for one second that this thing is over. The way I see, it it's the only thing the banks could attempt to do. If their foreclosure operation remained shut down the ramifications would be devastating.

Massive inventories would begin to build up and prices would then collapse, and Bank of America would then likely collapse right along with them.

So the table is now set for one of the largest legal wars in history. The banks versus J6P. The financial system will likely hang in the balance.

BTW, This is a political nightmare for the boys in DC:

On one side you have the huge pensions who own trillions of these MBS that may prove to be worth nothing if the judges rule in favor foreclosuregate.

On the other side you have the banks and all of their power and influence.

The Republicans and the Democrats will both be forced to take sides here and it's a tough one. I think in the end they end up walking away from the banks in the end at least publicly. The pensions are too powerful a force vote wise to abandon.

Don't feel sorry for the banks if they lose. I am sure they will be taken care of in some shady fashion. The banks may have new names but I don't expect much to change. After all, the rule of law in this country has been absent the last few years. Why should we hold out any hope that it's coming back anytime soon?

The Bottom Line:

The Fed is doing everything in it's power to get you to spend and speculate like a drunken sailor.

I say don't take the bait. It's your decision of course.

I have spoken to a few investment advisor friends of mine the last few days who have told me that they are buying stocks knowing full well that they are overvalued. The problem is if they don't participate then they fall behind on performance versus their peers.

This is a classic sell signal because you know they won't hesitate to push the sell button. they have no conviction behind the positions they have taken so a mass exodus could be in the making if the market starts to roll over. I wouldn't be surprised if many of these kinda positions have very tight stops which could make it worse.

The market is being bought for all the wrong reasons: Speculation, greed, yield chasing, and fear. When you see good stocks like IBM and Apple selling off after solid beats you should take notice and consider it a shot across the bow.

The falling dollar is another warning sign. Everyone loves to buy stocks right now when the dollar drops. they say the market is "pricing in inflation". I say hogwash.

Folks, this trade will not last forever. A strong economy is always backed by a strong currency.

Come back here when we have $150 dollar oil with a weak dollar and let's see where the stock market is.

The Fed can play their games and it will work for awhile. The problem is they don't have the money to sustain it. Enter at your own risk.

Disclosure: No new positions taken at the time of publications.

Jeff(me)"Hello Mr. Smith."

Mr. Smith: "Hi Jeff. You have any investment ideas?"

Jeff: "Yes, I advise you to buy everything?"

Mr Smith: "Huh?"

Jeff: "Everything was up again today..... Stocks, bonds, gold, silver. I suggest you buy all of it."

Mr. Smith: "That is unusual isn't it?"

Jeff: "I know I know it's not supposed to happen but c'mon Mr. Smith. The dollars down! Every investment goes up now just like housing does...You just have to join the party."

Mr Smith: But what about the fundamentals?

Jeff: "Did you just ask me about the fundamentals? HAHAHA.. Don't be so silly Mr. Smith! Who cares about those? Trust me...NOW is the time to buy. You gotta be in it to win it!"

Let me pause here. I just thought of a great idea for my pitch:

I think I might crank a tune up in the middle of my sales pitch so he can get a feel for how fun it is when everything goes up.

Ah! here we go. This one would be PERFECT:

Back to my role play

Mr. Smith: "Jeff, I don't know, I am really concerned about the dollar. Oil was up $2.00 again today."

Jeff: "Oil schmoil. Apple just rocked up over $315!"

Mr. Smith: "Aren't you concerned about the currency wars? The Yen just broke to new highs again today against the dollar."

Jeff: "Mr. Smith. When was the last time you were over in Japan? Do you really think that bothers us over here?...Mr Smith, Trust me. It's time for you to GET IN THE GAME MY FRIEND! DON'T GET PRICED OUT!"

Sarcasm Off

Sadly, in the real world, Mr. Smith likely would have taken the bait and given me his lifetime savings to invest into this casino.

Folks don't kid yourselves: This is a casino. This betting parlor has been purposely created by The Fed with it's zero interest rate policy. I showed you the game that was being played today by the Fed in this morning's post.

Money is flying all over the place just like you would see at a craps table at 3AM in Las Vegas. Everyone is taking numbers and hoping the "stock gods" that are backed by the Fed somehow take us higher.

Unemployment, the economy, and investing are no longer important. Investors aren't invited to this party. In fact, there is a sign on the door of the market that says "speculators only".

Sadly, most of the clowns that are "all in" will stay at the party too long and will end up getting caught with their pants down. It's no different then the guy who walks into a casino for the first time and wins $5000 in the first hour only to find himself broke with a $1000 hooker on his lap by the end of the night.

Apple and IBM Earnings

Apple and IBM both beat solidly after hours. IBM sold off pretty hard on the news and Apple was halted last I checked. Looks like the market isn't happy with the numbers. Futures are down.

As I have said before, the market is priced for perfection. Beating isn't enough. You need to "Google" it and beat by 20+% in order to Ponzi your stock up to higher levels.

Forclosuregate Intensifies

This just keeps getting uglier by the second. Bank of America announced today that it plans on restarting the foreclosure "boiler room" in 23 states next week. The legal profession keeps telling them "not so fast my friend" and continues to take on foreclosure victims as clients.

Take some time and watch this video of 30 year real estate attorney April Charney who warned about this problem several years ago:

My Take:

The money quote from April is this: "The profit was separated from the risk". Essentially, the insinuation here is that the banks got their profits up front and didn't really care how clean the securitization was as long as Moody's rated it AAA.

I am sure BAC has met with their lawyers and have developed new paperwork in order to start foreclosing again. I am sure they have also put together a defense for the people who have already been thrown out of their houses.

I don't buy it for one second that this thing is over. The way I see, it it's the only thing the banks could attempt to do. If their foreclosure operation remained shut down the ramifications would be devastating.

Massive inventories would begin to build up and prices would then collapse, and Bank of America would then likely collapse right along with them.

So the table is now set for one of the largest legal wars in history. The banks versus J6P. The financial system will likely hang in the balance.

BTW, This is a political nightmare for the boys in DC:

On one side you have the huge pensions who own trillions of these MBS that may prove to be worth nothing if the judges rule in favor foreclosuregate.

On the other side you have the banks and all of their power and influence.

The Republicans and the Democrats will both be forced to take sides here and it's a tough one. I think in the end they end up walking away from the banks in the end at least publicly. The pensions are too powerful a force vote wise to abandon.

Don't feel sorry for the banks if they lose. I am sure they will be taken care of in some shady fashion. The banks may have new names but I don't expect much to change. After all, the rule of law in this country has been absent the last few years. Why should we hold out any hope that it's coming back anytime soon?

The Bottom Line:

The Fed is doing everything in it's power to get you to spend and speculate like a drunken sailor.

I say don't take the bait. It's your decision of course.

I have spoken to a few investment advisor friends of mine the last few days who have told me that they are buying stocks knowing full well that they are overvalued. The problem is if they don't participate then they fall behind on performance versus their peers.

This is a classic sell signal because you know they won't hesitate to push the sell button. they have no conviction behind the positions they have taken so a mass exodus could be in the making if the market starts to roll over. I wouldn't be surprised if many of these kinda positions have very tight stops which could make it worse.

The market is being bought for all the wrong reasons: Speculation, greed, yield chasing, and fear. When you see good stocks like IBM and Apple selling off after solid beats you should take notice and consider it a shot across the bow.

The falling dollar is another warning sign. Everyone loves to buy stocks right now when the dollar drops. they say the market is "pricing in inflation". I say hogwash.

Folks, this trade will not last forever. A strong economy is always backed by a strong currency.

Come back here when we have $150 dollar oil with a weak dollar and let's see where the stock market is.

The Fed can play their games and it will work for awhile. The problem is they don't have the money to sustain it. Enter at your own risk.

Disclosure: No new positions taken at the time of publications.

Fed's POMO Burns the Shorts Once Again

The Fed's POMO was successful once again today as the Fed continues to pump dollars into the primary dealers by buying billions in treasuries from the banks. The PD's then take that money and buy risky assets like stocks and gold. This explained today's reversal.

Here are the numbers from today's POMO:

My Take:

You can see an immediate correltation in bonds as the POMO's were wrapped up. Take a look at the 30 year right around the 10-11:00 hour as this sham was completed:

Gold also ramped as this monetization of our debt via POMO was completed this morning:

The Bottom Line:

I think there are a few more POMO's scheduled this week. Short at your own risk here. I will keep some hedges short as protection but that's about it.

You have two choices in a market like this. Go long and buy total piece of crap stocks that are being constantly pumped up to ridiculous valuations by the Fed OR stay in cash.

I will play their game by owning some metals which should also benefit from the Fed's POMO donations to the big banks. I figure at least I will own something of value when the music stops.

Don't be fooled here folks, these POMO's are PURE printing and it helps explain why you have seen gold soar to $1350 this year.

The reality here is this printing is unsustainable and it will end up destroying our currency which coincidentally proceeded to drop like a rock following today's action by the Fed.

Here are the numbers from today's POMO:

My Take:

You can see an immediate correltation in bonds as the POMO's were wrapped up. Take a look at the 30 year right around the 10-11:00 hour as this sham was completed:

The Bottom Line:

I think there are a few more POMO's scheduled this week. Short at your own risk here. I will keep some hedges short as protection but that's about it.

You have two choices in a market like this. Go long and buy total piece of crap stocks that are being constantly pumped up to ridiculous valuations by the Fed OR stay in cash.

I will play their game by owning some metals which should also benefit from the Fed's POMO donations to the big banks. I figure at least I will own something of value when the music stops.

Don't be fooled here folks, these POMO's are PURE printing and it helps explain why you have seen gold soar to $1350 this year.

The reality here is this printing is unsustainable and it will end up destroying our currency which coincidentally proceeded to drop like a rock following today's action by the Fed.

Sunday, October 17, 2010

What a Falling Dollar Means For You

I hope everyone had a great weekend. I am back after a weekend getaway.

As we all watched the dollar fall like a rock last week, I figured tonight would be a good time to talk about the ramifications of a weaker US dollar.

Peter Schiff did a great job explaining what it really means in this piece from the Tech Ticker so I'll let him do the talking.

Peter took a lot of heat the last few years on his crashing dollar/decoupling thesis as the dollar soared when the global financial system appeared to be on the brink of collapse. I think he was right but just a bit early. He did nail the gold trade.

I will be back in the saddle all next week so you can expect to hear a lot from me. As I said earlier, I think we are beginning to see signs that the Fed is beginning to lose control of things in the markets.

The next several weeks are going to be critical. Futures are off to a nasty start tonight. Gold is down sharply and the dollar is bouncing up a tad which is to be expected after last week's tailspin.

Longer term the outlook for bucky remains murky at best. We have several Fed POMO's next week so I don't expect things to get too nasty. In fact, I wouldn't be surprised to see stocks hold up next week despite the fact that it appears we are going to get off to a rough start in the moring.

Time will tell.

As we all watched the dollar fall like a rock last week, I figured tonight would be a good time to talk about the ramifications of a weaker US dollar.

Peter Schiff did a great job explaining what it really means in this piece from the Tech Ticker so I'll let him do the talking.

Peter took a lot of heat the last few years on his crashing dollar/decoupling thesis as the dollar soared when the global financial system appeared to be on the brink of collapse. I think he was right but just a bit early. He did nail the gold trade.

I will be back in the saddle all next week so you can expect to hear a lot from me. As I said earlier, I think we are beginning to see signs that the Fed is beginning to lose control of things in the markets.

The next several weeks are going to be critical. Futures are off to a nasty start tonight. Gold is down sharply and the dollar is bouncing up a tad which is to be expected after last week's tailspin.

Longer term the outlook for bucky remains murky at best. We have several Fed POMO's next week so I don't expect things to get too nasty. In fact, I wouldn't be surprised to see stocks hold up next week despite the fact that it appears we are going to get off to a rough start in the moring.

Time will tell.

Subscribe to:

Posts (Atom)